Composition is an alternative mode of tax levy to provide simplicity to small taxpayers so that they need not indulge in dilemma of different rates, input credit and other complicacies. This is a optional method available to small taxpayers whose annual turnover of less than Rs. 1.5 crore or 75 lakhs (in specified states)

Application for opting composition scheme for a year can be filed by CMP-02 before start of financial year i.e., application for opting composition scheme for the year 2021-22 could be availed by Mar. 31, 2021. Once a taxpayer exercise option for composition scheme, he needs to reverse the ITC availed on good held in stock and capital goods within 60 days of commencement of relevant year. He also needs to declare the stock held on the day preceding the day of exercising the option of composition with 90 days of exercising the option.

Applicability of composition scheme– Scheme will be applicable on all the GSTIN held in a PAN e.g.: if GSTIN has been taken in state of Maharashtra, Rajasthan and Uttar Pradesh then composition scheme will be applicable on turnover of all three states.

Who are not eligible for composition scheme-The following persons are not eligible for composition scheme-

(1) Any person who is supplier of services

Exception-

• Restaurant services

• Other services value of which does not exceed 10% of turnover in the preceding financial year or Rs. 5 lac, whichever is higher

(2) He engaged in supply of goods/services which are not leviable under GST law

(3) He is engaged in inter-state supply of goods/services

(4) He is engaged in supply of goods through e-commerce operator who is required to collect TCS

(5) Supplier who has purchased any goods/services from unregistered supplier and has not paid GST on such goods/services on reverse charge basis.

(6) Any person who occasionally undertakes taxable transaction (Casual taxable Person)

(7) Any non-resident taxable person.

(8) Manufacturer of the following things: –

• Ice cream and other edible ice, whether or not containing cocoa

• Pan masala

• Tobacco and manufactured tobacco substitutes

Preparation of invoice by composition tax payer–

The bill issued by composition tax payer will be called “Bill of Supply” instead of “Tax Invoice”. It is so because composition tax payer is not allowed to collect tax.

Composition tax payer needs to mention the words “composition taxable person, not eligible to collect tax on supplies” at the top of bill of supply.

He also need to mention the word “composition taxable person” on every notice or signboard displayed at prominent place at his principal as well as every additional place of business.

No need to file fresh intimation every year– Intimation of filing tax under composition scheme need not to be given every year.

Filing of returns by composition tax payer– Composition tax payer need to file form CMP-08 every quarter to pay tax and furnish details of turnover of the quarter.

All the composition tax payers also need to file GSTR-4 on annual basis.

Advantages of opting for of composition scheme–

• Compliance of composition scheme is easy since no requirement of detailed books

• Only 5 returns in a year required to be filed

• Less rate of tax needs to be paid

Disadvantages of opting for composition scheme-

• Working scope of composition tax payer is very small since he has territorial limits

• Composition tax payer is not allowed to deal in good which are not taxable under GST

• Composition tax payer cannot sale using digital platform

Conclusion-

Composition scheme is good for small tax payers at initial level only, where they want to keep their compliance limited and cannot bear the compliance cost. In today’s era where business has no limits and it growing in fast pace on digital platform, it is required to opt for regular scheme.

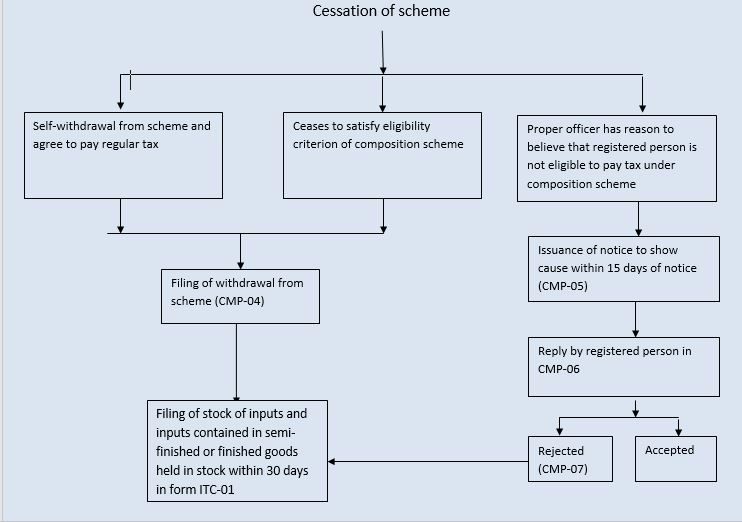

Cessation of scheme

POST COMMENTS