Refund under GST Laws

Even after completion of more than 2 years of GST and despite the government’s claim that they have been doing everything required to streamline the process, one thing is sure that the refund mechanism is still a mystery to the taxpayers.

This article aims to help you understand the process of filing of refund and make your life easier.

When can you apply for refund?

Generally, a taxpayer can apply for refund in the below mentioned cases:

- Export of Goods or services

- Supplies to SEZs units and developers

- Deemed Export supplies

- Refund of taxes on purchase made by UN or embassies etc

- Refund arising on account of judgment, decree, order or direction of the Appellate Authority, Appellate Tribunal or any court

- Refund of accumulated Input Tax Credit on account of inverted duty structure

- Finalisation of provisional assessment

- Refund of pre-deposit

- Excess payment due to mistake

- Refunds to International tourists of GST paid on goods in India and carried abroad at the time of their departure from India

- Refund on account of issuance of refund vouchers for taxes paid on advances against which goods or services have not been supplied

- Refund of CGST & SGST paid by treating the 283 supply as intra-State supply which is subsequently held as inter-State supply and vice versa.

Prerequisite to file refund application: –

You need to keep the following things in mind before proceeding for the refund application:

- All applicable returns due on or before application filing date should be furnished.

- The clubbing of successive tax periods should not be spread in two different financial years. i.e. in one application can be filed for April- March of a single financial year.

- Applicants who have opted for quarterly filing of GSTR 1 are allowed to file only for a quarter or clubbed quarter of a single financial year.

- Applicants applying under the following categories will not be able to file a refund application in same category for a financial year unless they have been issued a deficiency memo. Hence they need to claim carefully for all the eligible input in a go:-

- Refund of Unutilized ITC on account of export without payment of tax

- Refund of Unutilized ITC on account of supplies to SEZ/SEZ developer without payment of tax

- Accumulation due to inverted tax structure.

How to file the refund application under GST ?

Let us now try and understand the above-mentioned steps further:

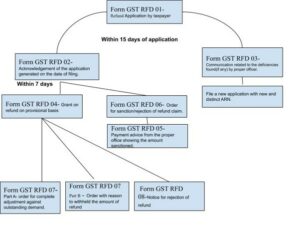

Step 1: Firstly, you need to start with filing of Form GST RFD 01 through the GST portal for the period for which you want to claim refund.

This application should be filed within filed within 2 years from the relevant date in form and manner as prescribed in Section 54(1) of the CGST Act.

Step 2: Your application will be forwarded to Proper officer, who shall scrutinize the application for the completeness as per the rule 89 (2), (3) and (4) and an acknowledgement shall be available electronically on the GST portal under Form GST RFD -02.

In case, there are any deficiencies noticed, the proper officer will communicate those electronically through Form GST RFD – 03 and the amount will re-credited to the electronic credit ledger and applicant will then be required file a fresh refund application after rectification of such deficiencies.

This communication (GST RFD-02 or GST RFD-03) is required to be completed within 15 days of filing of refund application.

Step 3: In case of zero rate supplies (i.e. Export of goods or services nor supplies to SEZ), Provisional refund can be granted by the proper officer Within 7 days of acknowledgement in Form GST RFD 02 by an order in Form GST RFD 04 provided:

- The taxpayer has not been prosecuted under GST or any existing law where amount of tax evaded exceeds Rs 2,50,000/- during any period of 5 years immediately preceding the period of claim.

- Post scrutiny of the claim and evidence submitted, the amount claimed as refund is in accordance with section 54(6) of the CGST act.

Step 4: The proper officer shall also be required to issue a payment advice in FORM GST RFD-05 for the amount sanctioned and the same shall be electronically credited to the bank accounts mentioned in the application.

Step 5: After examination of application, the proper officer shall make an order in Form GST RFD 06 sanctioning the amount of refund and mention the amount refunded on provisional basis, amount adjusted against any outstanding demand under GST or any existing law and the balance amount refundable.

Step 6: In case, the amount of refund is completely adjusted against any outstanding demand under the Act or under any existing law, an order shall be issued in Part A of FORM GST RFD-07 with the details of adjustment.

Also, if proper officer is of the opinion that the amount of refund is liable to be withheld, he may pass an order in Part B of FORM GST RFD-07 informing the reasons for withholding of such refund.

Step 7: in case the whole or any part of the amount claimed as refund is not admissible/payable to the applicant, the proper officer may issue a notice in FORM GST RFD-08to the applicant.

Step 8: The applicant is required to furnish the reply to the above notice in FORM GST RFD-09 within a period of fifteen days of the receipt of such notice.

Step 9: After considering the reply, the proper officer may order in FORM GST RFD-06 sanctioning/rejecting the amount of refund and the said order shall be made available to the applicant electronically.

Please note, as per the GST laws, the proper officer needs to process the refund application within 60 days from the date of submission of application.

If the officer fails to pass an order within the said 60 days, then the taxpayer shall receive an interest @ 6% p.a. for the period exceeding the expiry of 60 days until the receipt of refund.

POST COMMENTS